What is event-based data streaming, and why is it becoming a crucial solution approach for data-rich industries?

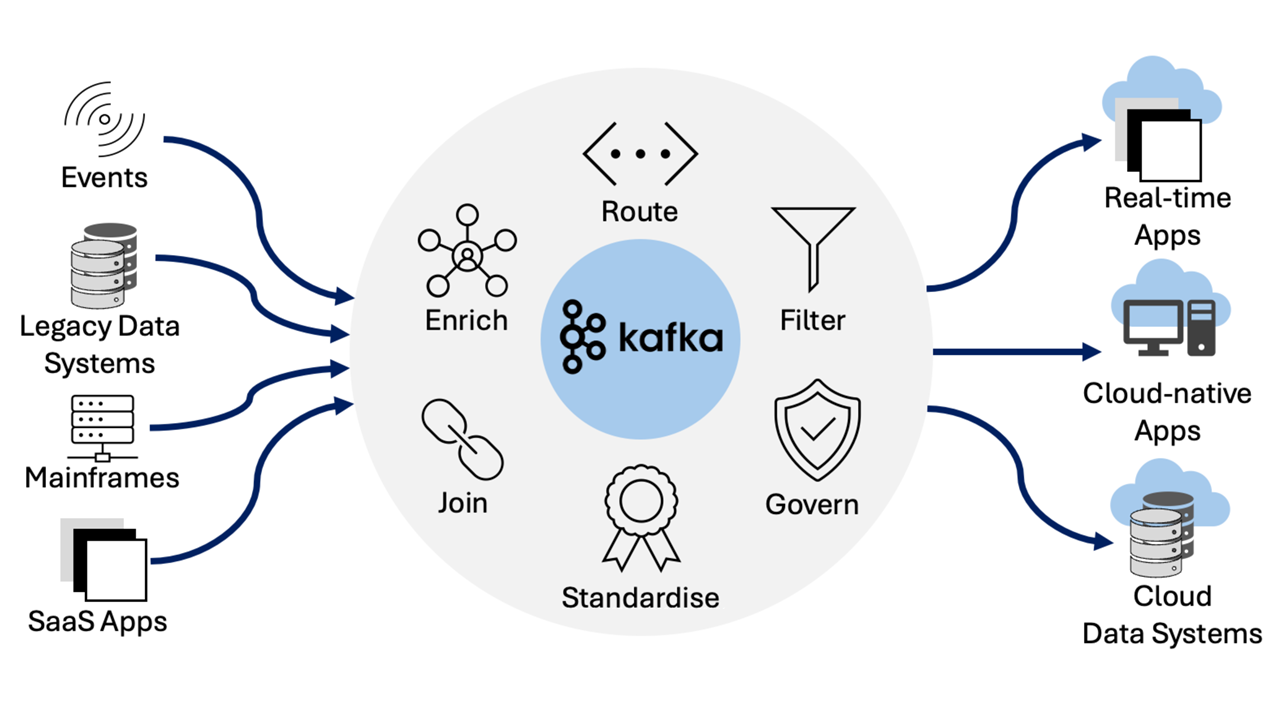

Data streaming is the continuous flow of data that is generated by various sources and processed in real-time. This data can come from a variety of sources, including databases, sensors, user activity, and social media.

Data streaming enables organisations to process and analyse large amounts of data as it is being generated, rather than waiting for the data to be stored and processed in batch mode. This allows organisations to gain real-time insights into the data and make informed decisions based on the most up-to-date information.

Examples of data streaming applications include enterprise integration, real-time analytics, fraud detection, IoT device management, and log management.

"Businesses move at a faster pace than ever before.

And accessing data in real-time is a critical component of delivering a competitive advantage strategy."

Data streaming is the recognised approach for solving the latency-of-access challenges inherent with traditional, on-prem or stale-data systems.

Stale-data systems refer to systems or processes that rely on outdated or obsolete information. These systems are no longer fit for purpose because they can lead to inaccurate decision-making and cause various problems for businesses and organisations.

In today's fast-paced and constantly changing world, relying on stale data can lead to missed opportunities and increased risk.

For example, if a financial institution relies on outdated data to make investment decisions, they could make poor investments that lead to financial losses. Similarly, if a healthcare provider relies on stale patient data, they could make incorrect diagnoses or prescribe inappropriate treatments.

Moreover, stale-data systems can also lead to compliance and legal issues. For instance, if an organisation fails to update its records regularly, it may be in violation of data protection laws and regulations.

To stay competitive and operate effectively in today's data-driven world, businesses and organisations must ensure that their systems and processes are built on current and accurate data. This means implementing robust data management and governance practices, push data sources, and utilising advanced analytics and machine learning technologies to analyse and interpret data in real-time.

By doing so, they can make informed decisions, reduce risk, and stay ahead of the curve in their respective industries.

Data Streaming in Banking and finance

Data streaming is becoming increasingly important in the finance and banking industry as it enables real-time data processing and analysis, leading to improved decision-making, risk management, and customer service.

Fraud detection and prevention: Data streaming is used to monitor and analyse transactions in real-time to detect and prevent fraud. By analysing patterns and trends in data, banks can quickly identify unusual activity and take proactive measures to prevent fraud before it occurs.

Trading and investment: Data streaming is used to process and analyse large volumes of real-time market data, allowing banks to make informed decisions about trading and investment strategies. By leveraging real-time data, banks can respond quickly to changing market conditions and improve their performance.

Customer service: Data streaming is used to monitor and analyse customer interactions with bank systems and services in real-time. This helps banks identify customer issues and address them promptly, leading to improved customer satisfaction and loyalty.

Risk management: Data streaming is used to monitor and analyse risk factors in real-time, allowing banks to identify and mitigate potential risks quickly. By analysing data from multiple sources, banks can improve their risk assessment and management capabilities.

Compliance monitoring: Data streaming is used to monitor and analyse transactions and activities in real-time, allowing banks to ensure compliance with regulations and laws. By analysing data in real-time, banks can identify and address compliance issues before they become major problems.

Data Streaming for Aviation services

Data streaming has become increasingly important for airlines as they seek to improve their operations, optimise their resources, and enhance the overall customer experience.

Real-time flight tracking: Data streaming can provide airlines with real-time information on the location and status of their aircraft, allowing them to make informed decisions about flight routing, fuel consumption, and maintenance needs. This can help airlines improve their on-time performance, reduce delays, and enhance safety.

Predictive maintenance: By analysing real-time data from aircraft sensors, airlines can identify potential maintenance issues before they become major problems. This can help reduce the frequency of unscheduled maintenance events, improve aircraft reliability, and reduce the risk of flight cancellations.

Customer experience: Data streaming can provide airlines with real-time information on passenger behavior and preferences, allowing them to personalise their services and improve the overall customer experience. For example, airlines can use data to offer personalised recommendations on in-flight entertainment, food and beverage options, and other services.

Resource optimisation: By analysing real-time data on aircraft utilisation, crew scheduling, and other operational factors, airlines can optimise their resources to maximize efficiency and reduce costs. For example, airlines can use data to identify routes with high demand and adjust their schedules and pricing accordingly.

"Data streaming presents both the operational benefits and the customer experience uplifts that only 'real-time' data access can provide."

Use cases for Data streaming across a broad range of complex, data-rich industries:

- Retail: Data streaming is used in retail to track sales, customer behavior, and inventory levels in real-time.

- Healthcare: Data streaming is used in healthcare to monitor patient vital signs, monitor medical equipment, and track disease outbreaks.

- Telecommunications: Data streaming is used in telecommunications to monitor network performance, detect and resolve issues, and manage customer experience.

- Transportation: Data streaming is used in transportation to track the location and status of vehicles, manage supply chain logistics, and optimise routing and delivery schedules.

- Manufacturing: Data streaming is used in manufacturing to monitor production processes, track machine performance, and improve overall efficiency.

- Gaming: Data streaming is used in gaming to provide real-time data to players, enabling them to make informed decisions and interact with other players in real-time.

At Sida4, we understand the use cases for Data streaming and we know how to deliver solutions for them.

If your business currently relies on legacy batched data processing (or stale-data systems) or you would like to get more uplift and ROI from your current streams, then

let's start a conversation.

Publishing note: This article was originally published under the 4impact brand and is now represented by Sida4, their data enablement and integration focused sister company.

insights